Top 8 Apps to Send Money You Should Try

When it comes to splitting a check or paying back your friend for last night’s drinks, money-sending apps are the real MVPs.

The good ones make the whole you owe me thing less awkward and ridiculously easy. So, we dug through the options and rounded up the best apps for sending and receiving cash this year.

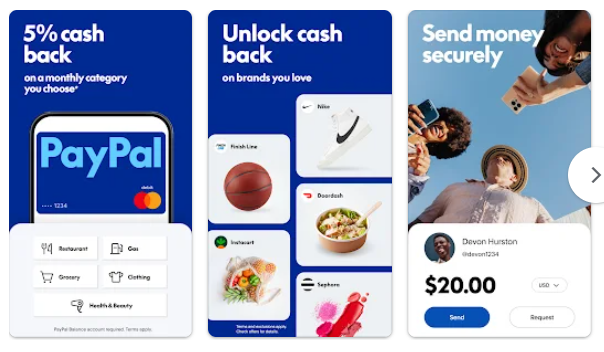

PayPal

PayPal’s been doing its thing since ’98, starting out as eBay’s go-to payment buddy and evolving into a full-on money-sending app with the PayPal: Mobile Cash app. It’s basically a money Swiss Army knife now—you can send cash, split bills, snag instant spending alerts, and even dip your toes into Bitcoin if that’s your jam.

Domestic or international? No problem. Linked bank accounts and PayPal cash transactions don’t cost a thing, but swipe a debit or credit card, and you’ll get hit with a fee. Heads up: their fee structure can feel like a maze, so maybe give it a once-over. Oh, and don’t expect lightning-fast transfers—it’s not exactly PayPal’s strong suit.

Google Pay

If you’re team Android, Google Pay feels like the obvious move. You can send cash to your people in the U.S. or India, knock out bills, and even set up autopay for stuff you don’t want to think about. Just don’t count on sending money overseas, and be ready for a few banks to throw a wrench in the works by not playing nice with your card.

Western Union

Western Union’s been in the game forever, and for good reason. They’ve got locations just about everywhere, making it stupidly easy to send money fast and securely, no matter where you or your recipient are.

You can do it your way too—send cash from the app using your card or bank account, or roll up to a local agent with physical cash in hand.

Your friend or family member can grab their money at a bank, a Western Union spot, or just get it sent straight to their phone. The catch? You’ll pay a bit more in fees, but hey, that extra cash buys you the comfort of tracking your transfer every step of the way.

Venmo

Venmo’s got that cool-kid vibe when it comes to money-sending apps. It’s owned by PayPal, so you know it’s solid, but it’s way more fun and easy to use. The app’s loaded with top-notch security, and if you’re into sharing or snooping, there’s a whole social feed where you can see who’s paying for what (don’t worry, you can keep it private too).

Fees aren’t too painful—debit and bank transfers are free, credit cards run you 3%, and instant transfers to your bank take a tiny 1% cut (maxing out at $10). They’ve even got Venmo cards for earning rewards and messing with your balance directly. Oh, and they’re business-friendly now, so whether you’re running a side hustle or a full-blown gig, Venmo’s got you covered.

Apple Cash

If you’re already in the Apple ecosystem, Apple Cash is basically a no-brainer. It’s baked right into Apple Pay, so there’s nothing to download, and sending money is as simple as firing off a text.

Whether you’re on your iPhone, iPad, or Apple Watch, it’s ridiculously smooth to use. The catch? It’s an Apple-only club. If your friends or family aren’t rocking an Apple device, you’re out of luck.

Zelle

Let’s be real—banks aren’t exactly killing it when it comes to keeping up with tech, especially for stuff like sending money. That’s where Zelle swoops in, making things way less painful.

If your bank’s already a Zelle partner, you can send cash straight from your bank’s app—no extra downloads, no hassle. If not, grab the Zelle app, and you’re good to go. The cool part? You can send money to people even if they don’t have a Zelle account, as long as their bank’s in the game.

WorldRemit

If you’re all about sending cash across borders, WorldRemit’s got your back. No minimums, lower-than-usual fees, and lightning-fast transfers make it a solid pick.

Your people can grab the money at a bank, get it sent straight to their account, or even have it dropped off at their door. They say it’s as quick as firing off a text, which is pretty wild. The trade-off? Don’t expect any flashy extras—it’s all business here.

Square's Cash App

If Venmo’s not your thing, chances are you’re rolling with Cash App—or maybe both, because why not? It’s just as simple to use and throws in extra perks, like discounts when you shop with their debit card.

Sending money to other Cash App users? Totally free, even for instant transfers. Want to pull cash out of your account? That’ll cost you a 1.5% fee. Oh, and if you’re feeling fancy, you can dabble in stocks or Bitcoin right from the app.